Private jet ownership is the pinnacle of flying. There is nothing quite like stepping onboard your own aircraft.

However, buying a private jet has many components that you need to navigate, especially when dealing with such high-value assets.

It’s important that you identify when the right time to buy a private jet is, which aircraft will fit your mission profile, how much it will cost, sourcing the right one, actually buying, then maintaining and using the aircraft.

There are so many aspects that all feed into purchasing the right aircraft.

As a result, here is the complete buyer’s guide on the process from start to finish to purchase a private jet.

This buyer’s guide is designed in order to simplify the process of buying the right private jet and provide a simple step-by-step process to help you own your own aircraft.

Benefits & Drawbacks of Private Jet Ownership

Firstly, it’s important to take a look at the overall benefits and drawbacks of private jet ownership. This is a great way to quickly decide if private jet ownership is for you.

Essentially, the primary benefit of whole ownership is that it allows for complete control over both the plane and the crew.

You know who has been on the aircraft, where it has flown, the hours it has logged, along with all of its maintenance and inspection history.

Additionally, you can customize and equip the aircraft in any way you wish. For example, you can choose upholstery, cabin layout, and in-flight entertainment, to name a few. Moreover, you can choose who flies the plane and can ensure the aircraft is maintained to your own personal standards.

However, this level of control can result in whole ownership being complicated, time-consuming, and expensive.

Whole ownership results in a series of fixed annual costs. For example, crew salaries, storage of the aircraft, maintenance, and insurance. Additionally, a series of schedule management needs to go on behind the scenes. For example, scheduling maintenance items and repositioning the aircraft so it is always ready for you.

However, these functions are usually outsourced to a third-party flight management company. Of course, even if management is handled in-house or outsourced to a dedicated provider, this will increase the cost of ownership.

It is also important to consider the tax implications of whole ownership. Of course, the tax situation will vary depending on the owner’s residency, the country registration of the aircraft, and whether the aircraft is used for business use or not. However, there can be significant tax benefits to purchasing a private jet. For example, if certain conditions are met, the IRS allows for 100 percent bonus depreciation on the purchase of a private jet.

Conversely, the depreciation of the aircraft is important to consider. Generally speaking, most private jets will depreciate in value over time (use the Aircraft Value tool to get the market value of aircraft). Of course, some aircraft hold their value better than others. Therefore, depending on the hours, market conditions, and aircraft type, depreciation in value can be minimized, making the cost of whole ownership reasonable.

Additionally, whole ownership allows owners to consider chartering out the aircraft when not in use. This will by no means result in a profitable venture, however, it can help to reduce the cost of ownership. Generally speaking, however, owners should be wary of chartering out their aircraft. Chartering the aircraft will result in increased wear and tear, along with increased hours. This increase will result in greater maintenance costs and a lower resale value.

Therefore, in the long run, the gains will be hard to realize. Moreover, the primary benefit of owning your own aircraft is to have it always available. However, if you charter the aircraft out then that freedom and flexibility disappear.

In conclusion, whole ownership is a great option if you want to have total control over your aircraft and crew. You can choose the exact model to suit your needs and can guarantee its availability. Moreover, if you are flying regularly it can be the cheapest option on a cost-per-mile basis.

Defining Your Mission Criteria

Next, let’s define your mission criteria in order to accurately find the best private aviation solution for you.

Knowing your anticipated annual mission usage and hours will help to influence whether it makes more sense to own or charter, for example.

Start by writing down all the missions that you expect to fly, along with how often you will be flying. From this, you will be able to calculate the number of hours flown (helpful in determining whether you fly enough to buy and also for calculating annual ownership costs). Additionally, knowing the missions will help to provide you with the minimum aircraft range required.

This activity is made really easy using the Compare Private Planes Flight Hour Calculator. Just input all the missions and have this data instantly calculated. You can access it here.

From these calculations above, we can now define our mission criteria and we know that an aircraft with a minimum stated range of 3,011 nautical miles is required. Of course, it is important to have a margin of safety with aircraft range so you will want to look at aircraft with over around 3,500 nautical miles.

Additionally, it’s important to evaluate your mission criteria in terms of profile type.

For example, with the missions above it may make sense to purchase a light jet for the European flights, and then charter a larger aircraft for the London to New York mission.

Additionally, if hours are low (below around 200 hours), and missions are highly varied, then chartering, jet cards, or fractional ownership may make more sense.

Is Private Jet Ownership for You?

So, how do you determine if private jet ownership is the best option for you?

Here are some factors that will influence whether or not you should own a jet. If you answer yes then private jet ownership will likely make sense for you.

- Need guaranteed use of aircraft on peak days (e.g. major holidays)

- Fly over 200 hours per year

- Want absolute control over the type of aircraft

- Make last-minute flight plans

- Change plans last minute

The purpose of private jets is to save you time. This is achieved through ultimate flexibility and mission customization.

Typically, aircraft ownership provides you this as you have sole control over it (unless you charter it out). As a result, if your plans change, you need last-minute flights, or you need guaranteed use on peak days, then ownership will provide this.

Additionally, the purchase of a private jet can be a smart financial move. If you (or members of your company) are flying more than around 200 hours per year, then the cost of ownership will likely be below that of chartering.

The Cost to Buy a Jet

So, at this point, you have decided that private jet ownership is the right decision for you. You fly enough for it to make sense. That’s great!

However, you need to make sure that ownership actually fits into your budget and that you can afford it.

Therefore, let’s take a quick look at the cost of actually buying a private jet.

Of course, depending on a number of factors, the price to buy a private jet will vary significantly.

Depending on the age of the aircraft, the airframe hours, engine hours, maintenance history, type of aircraft, and more, will all influence the price.

However, generally speaking, you will be looking at between just below $1 million to just over $50 million to buy a pre-owned private jet, with the majority of aircraft priced between $1 million and $5 million.

A brand new private jet will cost you between $3 million to over $70 million.

Therefore, if you do not have access to these funds, then private jet ownership isn’t achievable.

And, of course, this is before getting to the annual operating expenses.

The Cost to Operate a Jet

Once you have acquired your jet you need to pay to operate it.

You need to pay for the aircraft storage, maintenance, fuel, crew, insurance, and more.

Operating costs are split into two broad categories – fixed and variable costs.

Fixed costs are the necessary costs just to keep your aircraft airworthy and sitting on the ground (plus crew). These are independent of the number of hours flown.

Variable costs are those that are impacted by the number of hours flown and are usually referenced on a per-hour basis. For example, this will include fuel and ground fees.

While these costs will vary from region to region, they don’t change too dramatically.

For the cost to operate a private jet, you should expect to pay between $500,000 when flying 200 hours per year with a cost-efficient aircraft, to over $1.5 million for around 300 hours with a large jet.

Therefore, depending on the aircraft you are flying, $750,000 in annual operating costs is a safe margin for costs at this stage of the process.

Jet Classes

Now that you have established that owning a private jet fits within your budget, let’s have a quick look at the type of aircraft on offer.

- Very Light Jets

- Very Light Jets are the smallest private jets on the market.

- Typically, these aircraft are used for 1 – 2 hour legs. However, in optimal conditions, some VLJs can fly non-stop for around 3 hours.

- Generally speaking, VLJs can comfortably carry up to 4 passengers in a club configuration. In most cases, manufacturers claim additional passenger capacity by way of a belted lavatory and first officers’ seat in the cockpit.

- The VLJs listed are all certified for single-pilot operation. The result is a great way to keep ownership costs down, as only one pilot is required. Additionally, VLJs are suitable for owners who also wish to pilot their aircraft solo.

- Light Jets

- The light jet category holds some of the most popular private jets, with the Embraer Phenom 300/E being the best-selling private jet for the previous 10 years.

- Light jets are ideal for flights up to 3.5 hours, typically being able to carry 6 passengers in comfort.

- Many light jets are certified for single-pilot operation, making them ideal for owners who also wish to pilot their own aircraft.

- While many light jets claim to have the capacity for 8 – 10 passengers, this will typically include side-facing divans, belted lavatories, and the first-officers seat in the cockpit. Therefore, six passengers are, generally speaking, the maximum comfortable capacity. This layout will usually have 4 seats in a club configuration, along with 2 forward-facing seats.

- Most light jets have a maximum range of around 2,000 nautical miles, with an average fuel burn of 150 – 200 gallons per hour.

- Light jets are a great option when you are flying relatively short missions that are just outside the range of VLJs or the average number of passengers exceeds the comfortable limit of a VLJ.

- Medium Jets

- Modern medium jets typically have a range of around 3,000 nautical miles. Whereas, older midsize aircraft have a range that is more similar to light jets, with a typical range of around 2,000 nautical miles.

- For reference, a range of 3,000 nautical miles is, theoretically, enough to cross the Atlantic. However, with additional passengers onboard it is unlikely that a typical midsize aircraft will be able to comfortably fly from Europe to North America.

- However, an area where medium jets excel is domestic flying. For example, the light Phenom 300E is unable to fly from New York to Los Angeles without stopping to refuel. However, the Cessna Citation Latitude is able to comfortably cruise coast-to-coast, as well as from New York to Canada.

- Large Jets

- When it comes to the large jet category, there is quite a variation in price, operating costs, range, amenities, and performance.

- For example, the maximum range of large jets ranges from 3,000 nautical miles to 7,700 nautical miles.

- Additionally, the new list price of the current in-production large jets ranges from $21 million to $75 million.

- Typically large jets are used for long inter-continental journeys, with the largest jets being able to comfortably fly over 12 hours non-stop.

- Large jets are typically the flagships of aircraft manufacturers – with Bombardier, Dassault, and Gulfstream all competing with their flagship aircraft. The aircraft that they are using to compete are the Global 7500, 10X, and the G700.

Pre-Owned Vs New

And one final consideration before moving on to looking at specific aircraft, should you buy pre-owned or new?

Both options come with a slew of benefits. For example, pre-owned aircraft are immediately available and are less expensive. However, a brand new aircraft will come with a warranty and ensure that you always know its exact maintenance history.

Purchasing a new aircraft is when the aircraft has just rolled off the production line and you are the first owner of the aircraft.

Purchasing anything new is always an exciting experience. You can choose every individual detail, the anticipation of waiting for your new aircraft to be built, tested, and delivered to your hands.

- Benefits of Buying a New Private Jet

- Know the maintenance history of the aircraft

- Lower maintenance costs

- Manufacturer warranty

- Less downtime, more availability

- Configure aircraft (e.g. paint, interior, fabrics, etc.)

- Latest avionics, comfort, and technology

- Drawbacks of Buying a New Private Jet

- Higher initial costs

- Longer wait time to acquire

- Higher depreciation

Pre-owned aircraft are ones that have been owned by one or more owners before you. Providing that these aircraft have up-to-date maintenance records and certifications, they are just as safe as new aircraft.

Generally speaking, the older the aircraft, the less fuel efficient they are. Therefore, this is an important cost to consider when thinking you are getting a good ‘deal’ on an older aircraft.

Additionally, the older an aircraft gets, the more often it needs to be maintained and the more likely there is to be unscheduled maintenance. This, therefore, will increase the annual ownership costs.

The way that aircraft are built and maintained means that it isn’t uncommon to see aircraft still flying that are 20 or 30 years old. These aircraft are perfectly safe and provide the joys of private jet travel.

Additionally, even after an aircraft has been built, you can still customize and refurbish aircraft to meet you exact specifications. However, watch out for increased cabin noise levels and potentially less comfort than the latest and greatest aircraft.

- Benefits of Buying a Pre-Owned Private Jet

- Lower initial costs

- Available nearly immediately

- Kinks of new models worked out

- Higher availability of parts/maintenance

- Drawbacks of Buying a Pre-Owned Private Jet

- Will require refurb and upgrades to match your exact specifications

- Increased maintenance is likely, therefore more downtime

- Unlikely to be as fuel efficient as new aircraft

- Changing regulations means increased compliance upgrades

Technical Specifications

You know should know your basic criteria. You will likely know the minimum range that you require, the anticipated hours to fly, along with some information on how many passengers you anticipate to be flying with on a regular basis and the basic features that you require.

Next, you need to take a look at the technical specifications of each aircraft and compare them against each other.

This can be a time-consuming process to source all the data.

Let’s take a look at all the technical specifications to find and compare, all of which are available with our Premium service.

- Range

- As mentioned, the range is one of the most important factors when buying a private jet. You need to make sure that it can actually fly your missions. Stated range figures assume perfect conditions, so include a margin of error. And use the passenger slider with the Premium range map to see how more passengers onboard affect the range.

- High-Speed Cruise

- Everyone wants a fast jet. The faster it can fly, the sooner you arrive at your destination.

- Long Range Cruise

- This is important as it is the most efficient cruise figure. Therefore, if you are planning on flying to close to the maximum of the stated range figure, this cruise speed is more important to you.

- Max Altitude

- The higher an aircraft can fly, the thinner the air, the less traffic, and the more efficient the aircraft will operate.

- Rate of Climb

- The higher the rate of climb, the faster your aircraft can get to the optimum altitude.

- Initial Cruise Altitude

- Similar to maximum altitude. The higher the initial cruise altitude the better, as the aircraft will be able to operate more efficiently in the thinner air.

- Fuel Burn

- Fuel is one of the most significant variable costs. Therefore, the lower the fuel burn, the cheaper the aircraft will be to operate.

- Ground Performance

- Depending on the airports that you wish to operate from you may need to consider the take-off and landing distance. However, generally speaking, the shorter the take-off and landing distance, the more flexibility you have in the airports that you visit. If, however, you will only be visiting large, international airports, this is not too important a factor.

- Maintenance Schedules

- The more often your aircraft requires maintenance, the less often you can fly. Therefore, you want to be able to compare aircraft knowing how often they will be down for service.

- Passenger Capacity

- This one is important. You need an aircraft that can accommodate you and all your passengers. It is important to make sure that there is a margin of safety. For example, if you play to always fly with 3 other passengers, look for aircraft that can seat 6. Or the typical passenger configuration figure in the Compare Private Planes Premium section.

- Cabin Altitude & Sea Level Cabin

- The lower the cabin altitude, the more comfortable the cabin and the lower the impact of jet lag. The higher the Sea Level Cabin altitude, the more comfortable the cabin is as well.

- Cabin Volume

- A larger cabin allows for more space to move around, and more space for people, and luggage.

- Minimum Pilots Required

- If your aircraft only requires one pilot, then you can either operate it yourself if you are qualified or only need to employ one pilot, significantly reducing annual costs.

- Toilet, Flat Floor, Inflight Baggage Access

- These are all comfort features that you may require. Again, these are all available for over 140 private jets with Compare Private Planes Premium.

Operating Costs

Now it’s time to calculate the annual operating costs for each aircraft, tailored to your usage.

As previously mentioned, the operating cost for each private jet is split into fixed and variable costs.

Therefore, in order to get your personalized costs, you need to multiply your anticipated annual flight hours by the variable costs for each aircraft.

But how do you get these figures?

You can try calculating yourself for each private jet, spending hours researching each individual aircraft, and trying to verify the data.

Alternatively, you can use our Premium service which has all the data for over 140 private jets, split into each individual cost category. All you need to do is enter your annual flight hours and receive one complete figure. Moreover, the collection and calculation of the costs are available in our Methodology report.

For example, say you want to purchase a Beechcraft Premier I. All you would have to do is input your annual flight hours and receive the total cost, as seen below.

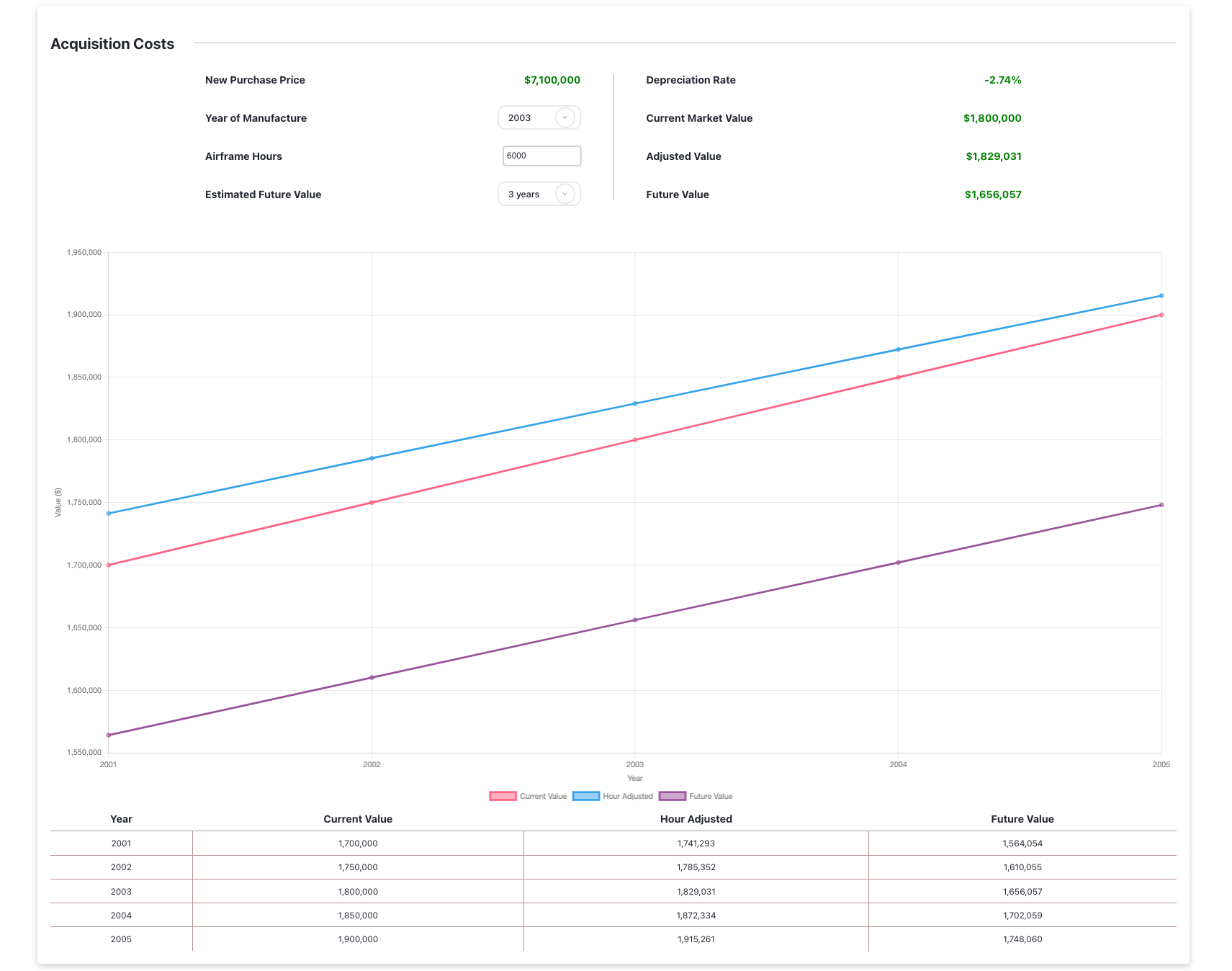

Acquisition Costs

After ownership costs let’s take a look at the acquisition costs. You need to make sure that the aircraft fits your budget and calculate the future value. This is useful to compare the actual cost of depreciation for each aircraft.

Again, you can try and research this for yourself for your desired aircraft. However, when looking at aircraft on the market, most do not have prices listed. Therefore, it can be hard to gauge the cost.

Again, using our Premium service you can instantly access over 1,000 model years worth of data, along with adjusted values for airframe hours and predicted future values.

So, taking the Beechcraft Premier I again, if we are interested in a 2003 model year with 6,000 airframe hours we can get an estimated market value. This is how much it will cost to go out and buy an aircraft like this.

Say you then wish to sell the aircraft in 3 years, you can then input this to get the outputted value.

As you can see from the data above, the cost to purchase a 2003 Beechcraft Premier I is estimated to be around $1.8 million. However, when we decide to sell in 3 years we can expect to get back around $1.6 million. This is thanks to its low depreciation rate.

From all these figures we can then get a complete cost to own over the 3 years.

It will cost around $200,000 in lost value of the asset, along with around $1 million per year in operating costs.

Therefore, every year, the real cost will be around $1.1 million.

As you can see, this was really easy using the Compare Private Planes Premium service.

Utilization

Knowing the utilization rate of current, in-service aircraft is helpful to determine how reliable the model is for the current owner’s activity.

If the aircraft model doesn’t fly a lot or has low annual hours, this isn’t too good of a sign.

Again, we can see this with the Premier I example.

The data above, again from Compare Private Planes Premium, tells us quite a lot.

Not only can we see the fleet total hours on the graph, but we can also see all the individual aircraft registrations, along with their individual flight hours.

Most of these aircraft aren’t flying that much per year. This suggests a significant amount of downtime for each aircraft. However, it also suggests that not too many hours per year are required in order to justify ownership of this model.

Market Data

Next, you will want to know how often a particular aircraft is being transacted.

The more often an aircraft is on the market generally means that it will be easier to acquire the aircraft, along with being easier to sell.

Sourcing the right aircraft can be tricky, therefore, by having more aircraft on the market, you will have a higher chance of finding the right aircraft that fits your needs.

Additionally, a higher number of transactions demonstrates that the aircraft is desirable. This, therefore, will make it easier to sell in the future.

Sourcing the Aircraft

There are many websites that provide listings for pre-owned aircraft. Some of the most popular are Controller, AvBuyer, GlobalAir, Trade-a-Plane, and Aircraft Exchange.

These websites all provide a way to get a good understanding of the aircraft there are currently on the market.

If you are looking to purchase a new aircraft, then some manufacturers provide configuration tools so you can see what and how you can customize each aircraft.

For example, you can configure your own Bombardier business jet.

In many cases, there will be “off-market” aircraft that will not be listed here. Therefore, it is a good idea to get in touch with brokers if you are unable to find your exact specification.

Complete the Acquisition

Now that you have decided on the model of aircraft that you wish to purchase, along with having sourced a few models, it’s time to complete the acquisition.

The acquisition process is complex with many moving parts. Therefore, you want to make sure that you have a solid team behind you that can complete this for you.

Unless you have your own in-house flight department, enlisting an external management company will make the most sense.

There are significant costs involved with creating your own in-house flight department. Additionally, crucial functions may be overlooked, there isn’t as much flexibility with your operations, and not all roles are full-time.

Once you have established your chosen aircraft and team, the next thing to do is send the Letter of Intent.

This starts the process of negotiating and purchasing the aircraft. Crucial points included in the Letter of Intent are the purchase price, detailed description of the aircraft, deposit amount and terms, delivery condition, and pre-purchase inspection plan.

If all goes to plan, the next step is putting down your deposit – typically 10% of the agreed purchase price. This should be held with a qualified escrow agent.

Next up is the Purchase and Sale Agreement (PSA) negotiation. This needs to be prepared by a qualified aviation lawyer as it is a complicated document stipulating conditions, payment, and inspections.

It is also critical to arrange a pre-purchase inspection. If you are spending millions of dollars on an aircraft, then you want to be sure that everything is in tip-top condition. The pre-purchase inspection will include factors such as an airframe inspection, avionics inspection, engine inspection, and test flight.

After all this, you will be ready to close the sale, including registering the aircraft with your desired aviation authority. This is the point that your team will obtain airworthiness certificates, maintenance plans, and insurance, and establish that everything is as agreed.

Private Jet Management

As mentioned, unless you have your own inhouse flight management department, you will want to outsource many responsibilities to a private jet management company.

These will be the people who look after your aircraft, along with helping you through the buying process.

Having your aircraft professionally managed removes a lot of stress for you (the owner), as they take care of it for you.

When you want to fly you just ring them up and they will organize the aircraft for you.

The typical responsibilities of a private jet management company include:

- Flight planning

- Flight booking

- Crew sourcing, hiring, and training

- Crew management and payroll (effectively HR)

- Aircraft airworthiness and certification

- Aircraft maintenance and repairs

- Invoice management (e.g. fuel, crew expenses)

- Post-flight cleaning, laundry, and restocking

- Ground transportation arrangement

- Charter operation (if desired)

Should You Charter Out Your Aircraft?

Chartering out your private jet will help to offset some of the costs of ownership.

That’s the big benefit. You will reduce your operating costs. However, you will unlikely profit from chartering our your personal jet.

Additionally, chartering out your aircraft comes with many downsides and removes many of the initial benefits of aircraft ownership.

Firstly, usage. More hours will be put on the airframe and engines. It will, therefore, be required to undergo maintenance more often. It will also reduce the value of the aircraft when it comes time to sell.

Secondly, you will have less flexibility with your schedule. If you can predict exactly when you will use your aircraft then that is fine. However, if your use is unpredictable then you will have to schedule your time just like a charter.

Additionally, you will unlikely be able to fly during peak times – one of the key benefits of ownership!

Therefore, if you want to reduce your annual costs then chartering makes sense. However, you will need to factor in the additional hours in terms of depreciation when it comes time to sell. You will also need to factor in the value of your time.

Maintenance and Engine Programs

Many owners choose to enrol their aircraft on a maintenance program.

Maintenance programs allow for owners to budget their maintenance based on the hours the aircraft fly. Essentially, you pay an hourly fee as you fly for a maintenance program. As a result, this helps avoid large expenditures when major maintenance events are due.

Moreover, purchasing a pre-owned aircraft that has been enrolled on a maintenance program provides you with greater knowledge about the maintenance history of the aircraft.

Maintenance programs can be tailored to cover scheduled maintenance events, unscheduled events, labor costs, rental engines, transportation fees, or refurbishment. This list is by no means exhaustive.

One way to view a maintenance program is like insurance. You pay a fixed fee to have the peace of mind that when maintenance is required, you aren’t going to have a hefty fee to pay as you have already effectively paid in installments.

As you can see with the maintenance programs below, the majority of programs are to cover the engines, especially when a major overhaul is required.

Private jet engine maintenance is one of the biggest costs within the whole maintenance category.

However, there are programs that cover other aspects of the aircraft. For example, you can have maintenance programs for the APU, airframe coverage, parts coverage, and – in the case of JSSI – tip-to-tail coverage that covers the entire aircraft.

Typically, most aircraft will be enrolled on an engine and APU maintenance program.

As previously mentioned, these programs can be tailored to your needs. It is up to you whether you want the peace of mind to cover all maintenance events, scheduled or unscheduled, or just one of these occurrences.

Every engine that is bolted to a private jet will come will have the option for a maintenance program for the engines. Of course, this is not mandatory.

Outside of the engines, there are a few independent programs, along with options from selected manufacturers.

- Rolls-Royce Corporate Care Enhanced

- Honeywell Maintenance Service Plan

- JSSI

- GE OnPoint

- Pratt & Whitney Eagle Service Plan

- Bombardier Smart Services

- Engine Assurance Program

- Textron ProAdvantage

- Williams International TAP

Summary

You now have a complete roadmap for the purchasing process of a private jet. From checking if you should buy one, to selecting the right model, to assembling the team to help you acquire the aircraft.

Finding the right private jet to buy is easy with our Premium service.

Featured Image: Jean-Claude Caprara / Shutterstock.com